Largecap Compounders

A2S Portfolio last updated on: 27 July 2022

Alpha2Sigma rationale

-Companies with Good Managements integrity, capability, and performance track record.

-Alpha2Sigma is an Educational Firm with - Founders having 3 generations of investing

We have a research team of over 5 members, including CA's, MBA's,

Economics Honors graduate.

-The detailed research report is prepared on the basic study of the

-Daily tracking of stocks is done by studying the news items and corporate announcements.

-On ground research is done by interacting with

∰ Historical back-testing

Our team has over 10 years of successful track in creating wealth from stocks. We use our learnings from the past to select the best multi-bagger stocks.

-The company should be profitable.

- The company should be utilizing the cash generated from the business, in the best interest of shareholders.

Buying the stocks at the right price “RP”

Buying a Company at the right price helps us maintain a margin of safety on your investments.

This helps us generate higher capital appreciation. We use the income, market, and asset approaches to evaluate the valuations of the company.

The company should be Resilient, have a High Addressable Business Opportunity, should have high capital efficiency, have a competitive moat, and have management with integrity.

🏋Weighting

Following parameters are considered while assigning weights to stocks in this Basket

-Industry Exposure

🔍Rebalance

📌Important Fields

Inception Date

October 1, 2019

Launch Date

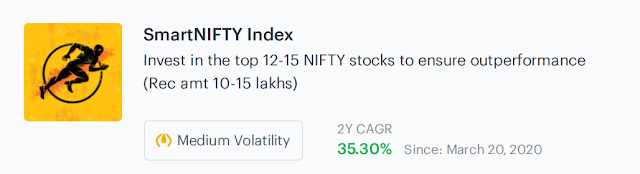

March 20, 2020

Marketcap Category

Equity Multi Cap

Review Frequency

Quarterly

Last Reviewed

June 27, 2022

Next Review On

💡General Investment Disclosure

Charts and performance numbers on the platform do not include any Backtested Data. Please refer to the Returns Calculation Methodology to check how returns Are calculated on the platform.

Data used for calculation of historical returns and other information is provided by exchange-approved third-party data vendors and has neither Been audited nor validated by the Company. To Basket where weights are not provided by the creator, Equal weights are used to calculate all returns, numbers, and ratios on the platform. The basket fact sheet might include a strategy Backtest if provided by the creator of the Alpha2Sigma. This is included to help users analyze the performance of the Basket across different economic cycles and long time horizons. STPL has not verified the backtest performed by the manager. We make no representations or warranties (expressed or implied) to any recipient n the contents of the backtest. Any information included in the backtest should never be construed as our representation or endorsement for the same.

STPL is not involved in the generation of the backtest and is not responsible for the contents of the same, nor do we verify the accuracy of the same. We do not have control over the backtest performed by the creator/manager of the Basket and neither do we play a determinative role in any calculation of the same. "Back-testing" is the application of a quantitative model to historical market data to generate hypothetical performance during a prior period. The use of back-tested data has Inherent limitations including the following:

A: The results do not reflect the

Results of actual trading or the effect of material economic and market conditions on the decision-making process, but were achieved by means of retrospective application, which may have been designed With the benefit of hindsight.B: The calculation of such back-tested performance data is based on assumptions integral to the model which may or may not be testable and are therefore subject to losses.

C: Actual performance may differ significantly from back-tested performance. Back-tested results are not adjusted to reflect the reinvestment of dividends and other income And, except where otherwise indicated, do not include the effect of back-tested transaction costs.

D: Back-tested returns do not represent actual returns and should not be interpreted as An indication of such.

E: Please note that past performance does not guarantee future returns.

All information presented in this document and related material is to help investors

in their decision-making process and shall not be considered as a recommendation orSolicitation of an investment or investment strategy.

Investors are responsible for their investment decisions and are responsible to validate all

The information is used to make the investment decision.An investor should understand

that his/her investment decision is based on personal investment needs and risk

tolerance and information available in this document and related material is one among

Many other things that should be considered while making an investment decision.

Stock and ETF investments are subject to market risks, read all related documents carefully.

Investors should consult their financial advisors if in doubt about whether the

product is suitable for them.

FOR INVESTMENT AND INQUIRIES

Manish Sunil Thole

7777067760 / manish@alpha2sigma.com

Comments

Post a Comment